The ruling sets out the sources of interest income which include. It does not apply to loansadvances funded from external loans or loans from third parties.

Corporate Income Tax In Malaysia Acclime Malaysia

The determination of the source of interest income is significant as only interest derived from Malaysia is taxable in Malaysia.

. For example the interest you earn off a fixed deposit or certain dividend payments are fully. In year 2014 the company receives interest amounting to RM10000. Youll be taxed if you gain profit from renting a house land vehicle or even goods used by someone where you receive money in return.

So your interest earned in an FD will attract 10 TDS and you are liable. Interest earned in 5 years Rs. Bank of China Fixed Deposit Account.

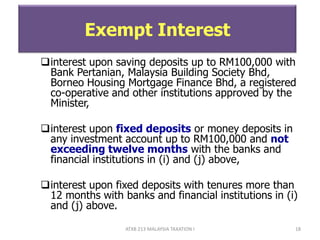

Interest received by individuals on money deposited in approved institutions which include all licensed banks and financial institutions is tax exempt. Interest earned per year Rs. Youll be taxed if.

Interest earned by an individual from fixed deposit account is exempted in the following situations- Period exceeding twelve months or more any amount of interest. Deposits with finance companies licensed in Singapore. You can deduct up to 7 of your aggregate income.

Foreign-sourced interest income is specifically tax exempt. 30000 5 Years Rs. The earned income interest from the fixed deposit is subjected to tax and you must pay taxes following applicable tax rates for the particular financial year under IT Act.

Interest Income Savings and Fixed Deposit from a Malaysian Bank P2P Lending Activities in Malaysia Lending to Steve Ma Sdn Bhd. Interest must be treated as being received by a person at the time when the person is entitled to the interest income accruing in or derived from Malaysia and is able to. Negotiable Instruments of Deposit.

Fixed deposit interest income taxable in malaysia. Income that you dont need to pay taxes for. Interest received from the following sources is not taxable.

The interest you earn on fixed deposits fall under Income from Other Sources in the income tax return and is fully taxable. Deposits with approved banks in Singapore. Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021 Malaysia Personal Income Tax Guide 2021 Ya 2020 Related.

Financial Deposit Product including fixed deposit and savings accounts. Maybank Islamic Prosperous Now. This type of income is excluded from counting as your taxable.

Cukai Pendapatan How To File Income Tax In Malaysia

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

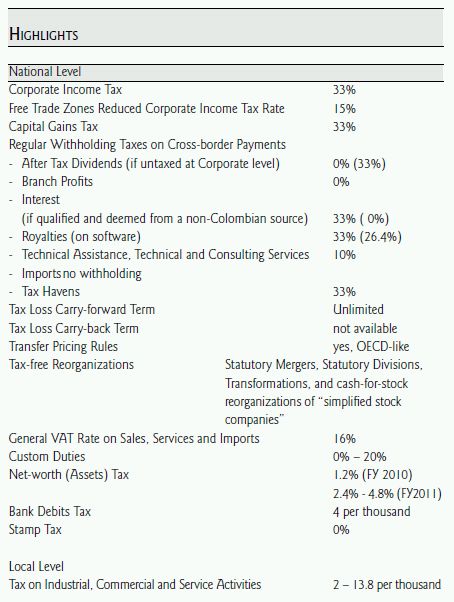

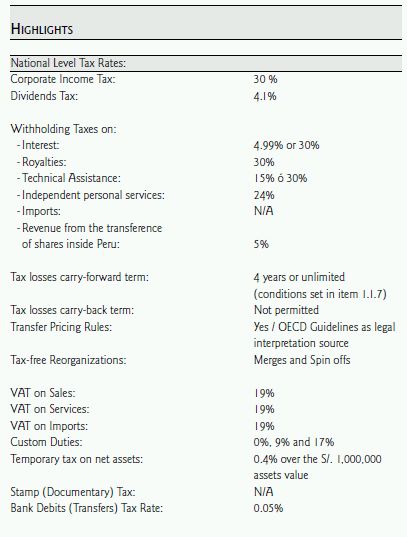

Managing Corporate Taxation In Latin American Countries Colombia Tax Authorities Colombia

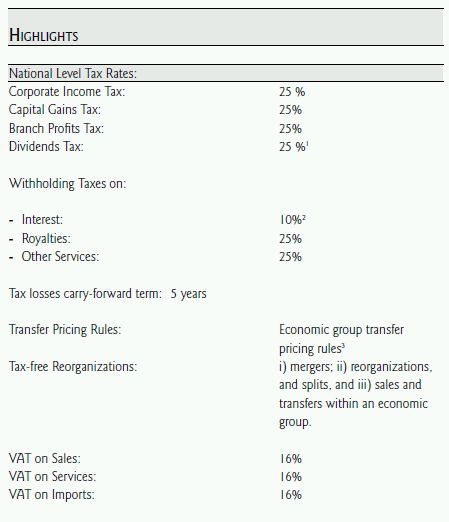

Managing Corporate Taxation In Latin American Countries Dominican Republic Corporate Tax Dominican Republic

Malaysia Personal Income Tax Guide 2022 Ya 2021

Section 80tta Tax Benefits Nri Can Claim 10 000 Inr On Interest Of Saving Account Nri Saving And In Investment Tips Savings And Investment Savings Account

Chapter 5 Non Business Income Students

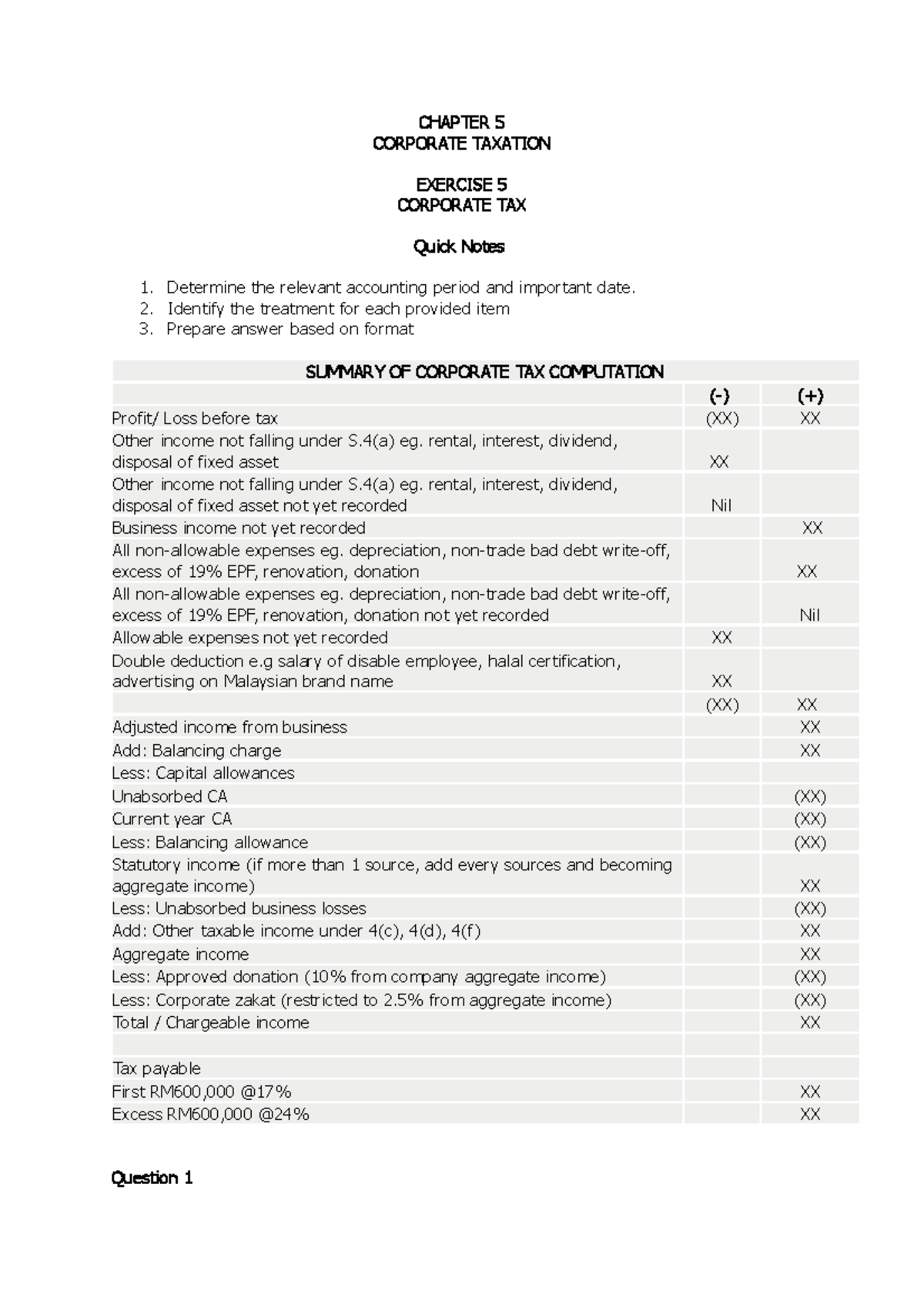

Chapter 5 Tutorial Taxation Chapter 5 Corporate Taxation Exercise 5 Corporate Tax Quick Notes Studocu

The Complete Income Tax Guide 2022

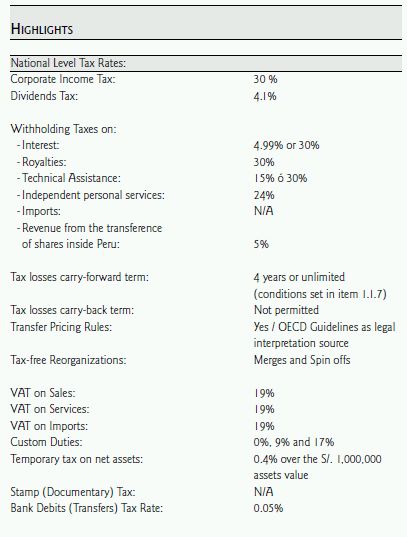

Managing Corporate Taxation In Latin American Countries Peru Corporate Tax Peru

Is It Mandatory To Declare Foreign Bank Accounts And Assets In Income Tax Return By Nri Nri Saving And Inv Income Tax Savings And Investment Investment Tips

Chapter 5 Non Business Income Students

Corporate Income Tax In Malaysia Acclime Malaysia

Calculate Your Chargeable Or Taxable Income For Income Tax

Income Tax Malaysia 2018 Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

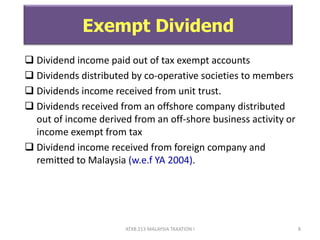

Taxation Principles Dividend Interest Rental Royalty And Other So

What Type Of Income Can Be Exempted From Income Tax In Malaysia

Personal Income Tax Interest Income Tax Treatment